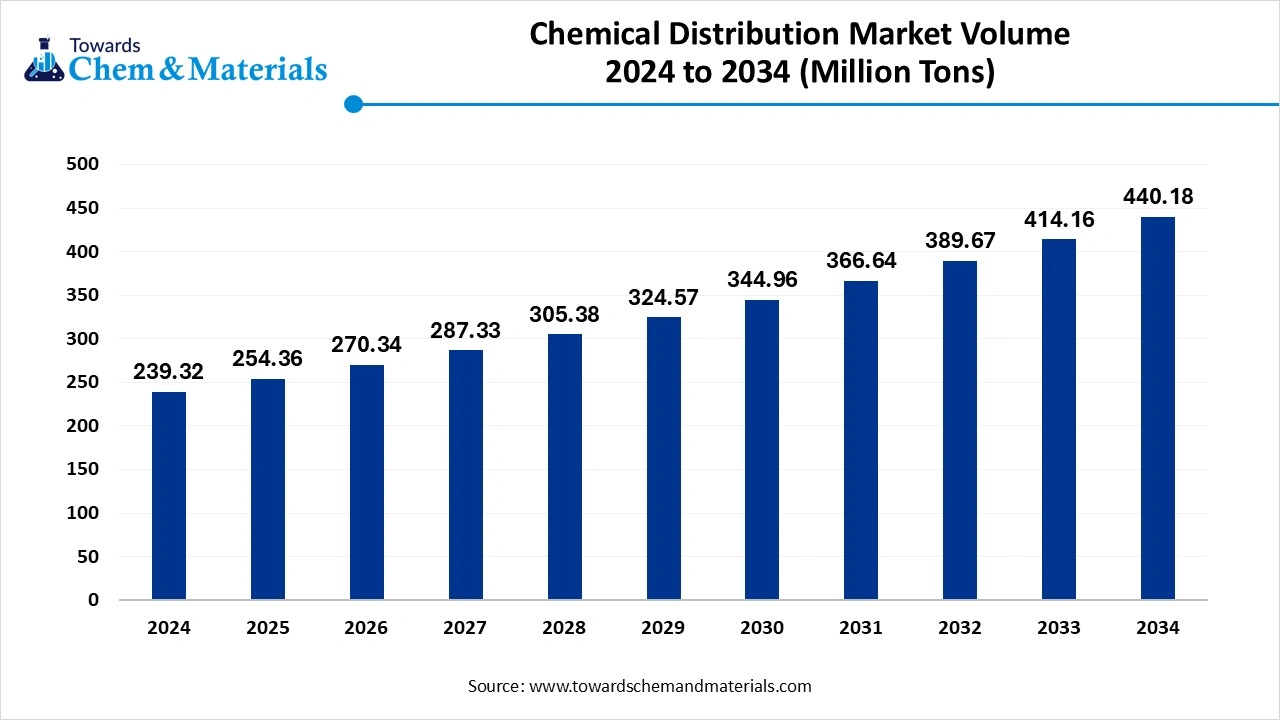

Chemical Distribution Market Volume to Worth 440.18 Million Tons by 2034

The global chemical distribution market volume is calculated at 239.32 million tons in 2024, grew to 254.36 million tons in 2025, and is projected to reach around 440.18 million tons by 2034. growing at a compound annual growth rate (CAGR) of 6.28% over the forecast period from 2025 to 2034. Asia Pacific dominated the Chemical Distribution market with a market volume share of 42.91% in 2024.

Ottawa, July 03, 2025 (GLOBE NEWSWIRE) -- According to Towards chem and Materials consultants, the global chemical distribution market volume was reached at 239.32 million tons in 2024 and is expected to be worth around 440.18 million tons by 2034. a study published by Towards chem and Materials a sister firm of Precedence Research.

The market is projected to grow due to strong demand across a wide variety of industries including pharmaceuticals, agriculture, and personal care. Growth is also derived from globalization of supply chains and demand for specialty chemicals in emerging markets.

The chemical distribution market facilitates the movement of bulk and specialty chemicals from manufacturers to end users through a network of logistics, storage, and value-added services. Distributors play a critical role in managing regulatory compliance, technical support, and supply chain efficiency. The market is undergoing transformation driven by rising demand for specialty chemicals, increased outsourcing by chemical producers, and stricter safety and environmental standards.

Digitalization is optimizing inventory, order management, and customer interfaces, while value-added services like blending and repackaging are enhancing distributor relevance. Competitive pressure is intensifying, prompting consolidation and vertical integration. Additionally, the shift toward sustainable chemicals is prompting distributors to diversify portfolios, adopt safer handling practices, and invest in green supply chain innovations.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5581

Chemical Distribution Market Report Highlights

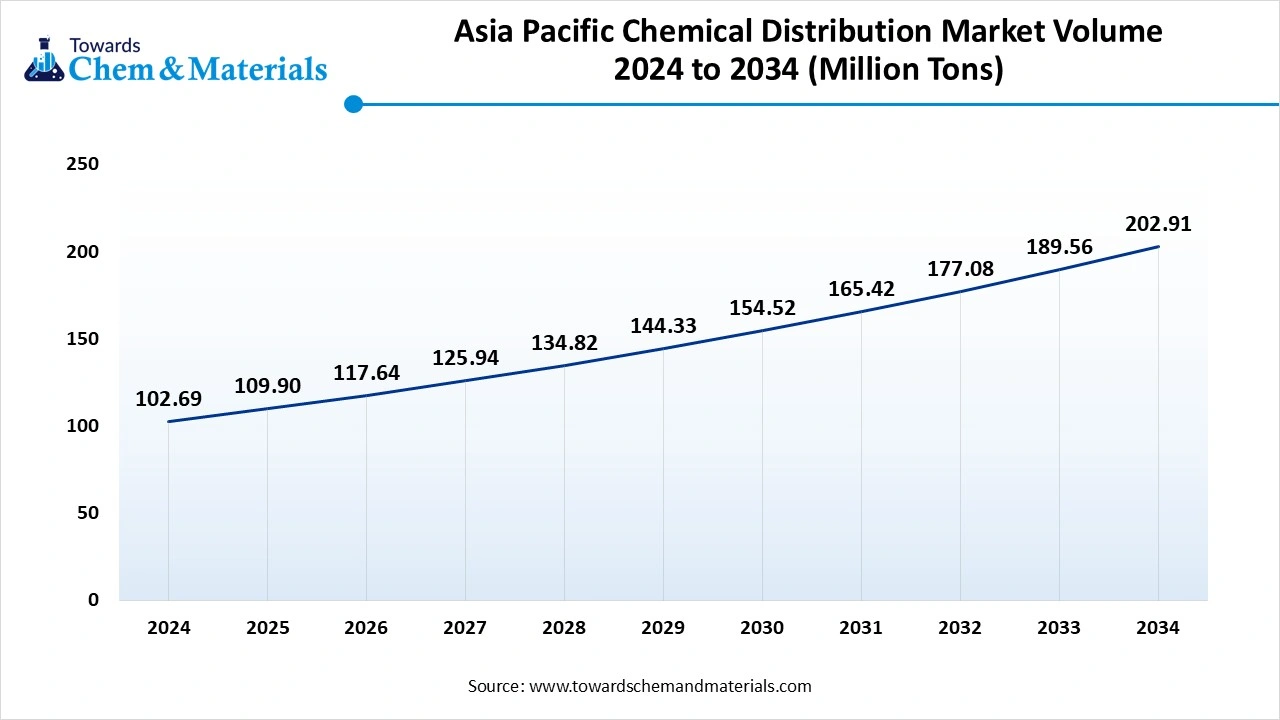

- The Asia pacific chemical distribution market volume is estimated at 109.9 million tons in 2025, and is expected to reach 202.91 million tons by 2034, at a CAGR of 7.03% during the forecast period 2025-2034.

- The Asia Pacific chemical distribution market dominated with the largest Volume Share of 42.91% in 2024

- The North America chemical distribution market is expected to grow at a CAGR of over 5.62% from 2025 to 2034

- The Europe has held Volume Share of around 22.12% in 2024.

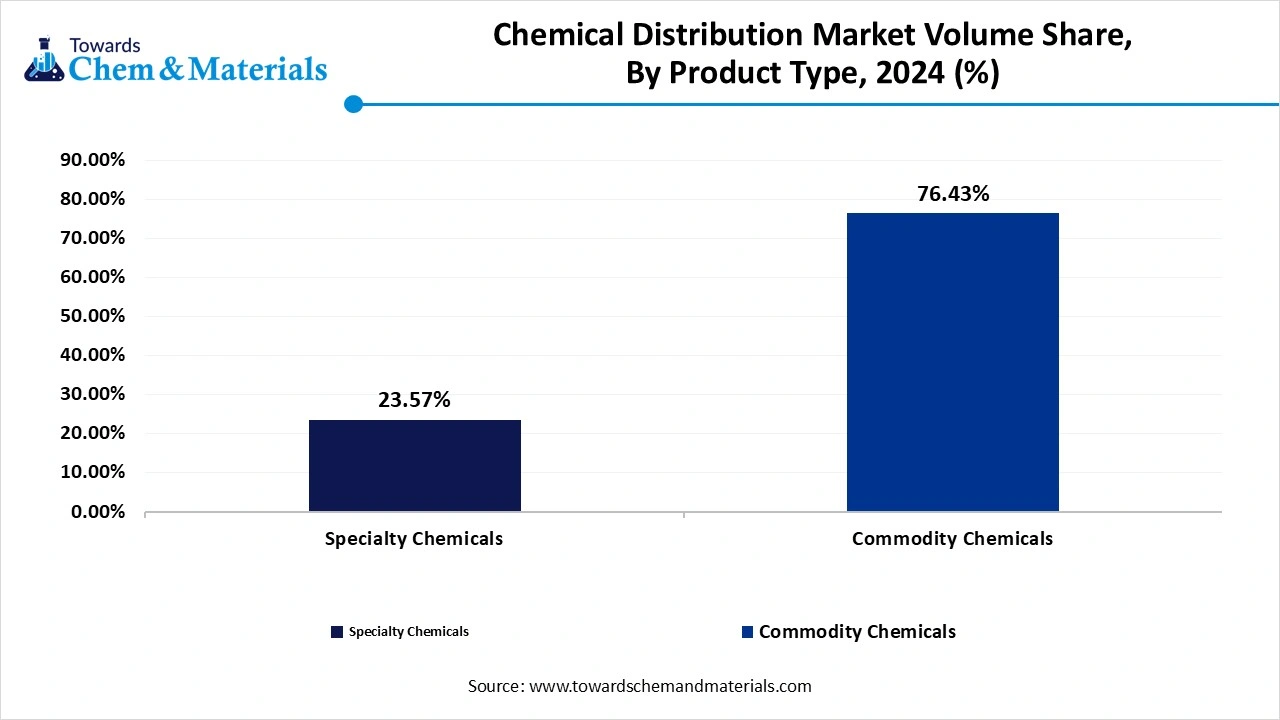

- By product, the Commodity chemicals segment led the market with the largest Volume Share of 76.43% in 2024.

- By product, the specialty chemicals segment is anticipated to register the fastest growth with a CAGR of 5.10% worldwide during the forecast period.

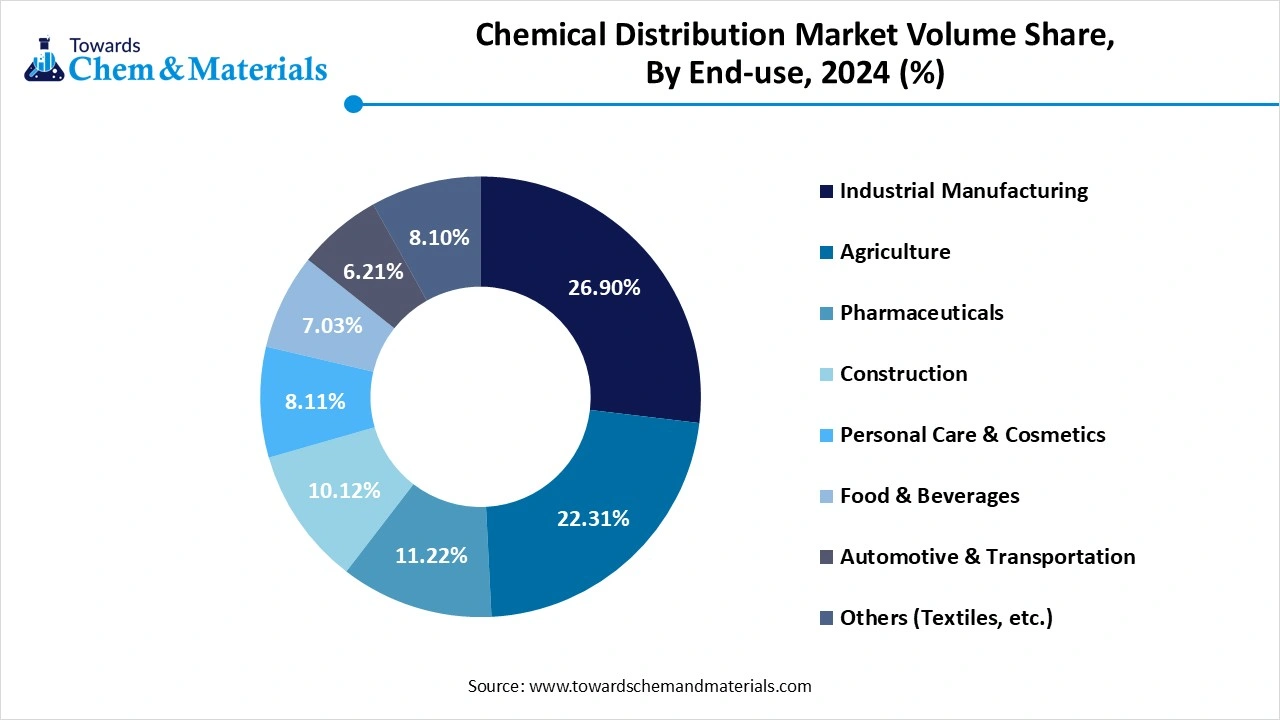

- By end use, the industrial manufacturing segment accounted for the largest Volume Share of 26.90% in 2024.

- By end use, the pharmaceuticals segment is likely to be the fastest-growing segment with a CAGR of 7.95% during the coming years.

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5581

What are the Major Trends in the Chemical Distribution Market?

- Growth of Specialty Chemicals- Distributors is moving from bulk to specialty chemicals with higher margins. Demand from pharmaceuticals, electronics, and personal care has led to the growth of specialized chemicals designed for a specific application.

- Digital Transformation- Automation, ERP integration, and digital customer portals are improving inventory management, order visibility and customer service, making operations more nimble and data-driven.

-

Broaden value-added services- Distributors are adding value-added services like custom blending, repackaging, and technical consulting to build long-term partnerships and differentiate themselves in an extremely competitive market.

What are the Drivers For Growth of the Chemical Distribution Market?

Growth in the chemical distribution market is happening, for many reasons, one of which must be stricter environmental regulations, compliance, and dangerousness of chemicals. Emissions from chemical facilities will be reduced by nearly 80%. according to U.S. Environmental Protection Agency (EPA) regulations for emissions, which pushed distributors to create safer, compliant practices. The UNIDO supported concept of chemical leasing (where usage is paid for rather than purchase), like pay-per-view, with usage-based models creating less waste and going towards efficiency.

There are about 13,500 chemical plants located in the U.S. with 89% of those plants producing specialty or batch chemical. Chemical distributors are benefitting from competitive advantages and goals associated with making improvements on a tailored basis to logistics, repackaging and storage. All these factors are changing the market focus to increasing importance on compliance, sustainability and customer service.

The Impact of AI on Chemical Distribution Market in 2025

Artificial intelligence is catalysing a strategic transformation in the chemical distribution sector, providing businesses with ways to reconfigure operations, improve accuracy and service, and raise the bar on customer experience. Distributors are looking to AI to devise accurate demand forecasts, automate repetitive and mundane tasks, and employ live data to improve supply chain route and management. AI-enabled tools can now manage catalogues of complex products, alert users to inconsistencies, and make decisions based on data more quickly.

Intelligent assistants powered by generative AI are now helping to complete tasks from reviewing contracts to communicating with clients in an individualized manner, freeing employees from heavy manual workloads. The overall success of implementation hinges on aligning goals, monitoring the state of data, and taking a phased approach to implementation with trial projects and refinement. AI is also augmenting customer service functions with automated CRM processes and intelligent search tools.

What Makes Chemical Distribution a High Untapped Chemical Distribution Opportunity?

The chemical distribution industry is continuing to grow considerably, particularly in specialty chemicals. The demand for specialized chemicals is anticipated to remain robust and has become more intensive and complicated. Overall, across the country, there are over 40 major M&A chemical distribution transactions that have occurred recently. The increasing M&A indicates a number of things including consolidation, scalability, and the value-added services by distributors, including the repackaging of bulk chemicals, providing specialized technical support, and just-in-time delivery, and compliance.

Also, globally, initiatives like the ICTA's responsible distribution framework encourage the many aspects of safety, sustainability, and market access. In emerging markets, for example, in India, there are opportunities to distribute certain products included in the global supply chain of agrochemicals and pesticides, water treatment, and industrial solvent markets due to the massive infrastructure projects and changing policies and regulations. The countries' various opportunities make chemical distribution globally relevant and unique as a strategic opportunity that can be scaled up.

Limitations and Challenges in the Chemical Distribution Market

- Environmental and safety regulations: Chemical distributors must adhere to many global and local regulations for the storage, transport, and handling of hazardous materials. This completely increases cost and complexity of the operations and often represents an obstacle for market access and leads to delays in the supply chain.

- Fluctuating raw material prices: Rapidly rising and falling raw chemical prices based on geopolitical events or fluctuations of supply and demand prevent distributors from accurately anticipating required margins and margins are tightly restricted for all distributors. As a result contracts cannot be established in the long term and often distributors will be obligated to absorb composure pricing before losing customers they have serviced for three generations.

-

Limited digital Adoption in emerging markets: Many small and medium-sized distributors, particularly in developing markets - establishing digital systems for managing inventory, logistics, and engaging with customers, enjoy a competitive advantage over any more 'digitally developed' players in the marketplace. Digitally translating operations is a starting point for scaling any level operation if financial resources exist.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5581

What Makes Asia Pacific the Dominant Region in Chemical Distribution Market?

The Asia pacific chemical distribution market volume is estimated at 109.90 million tons in 2025, and is expected to reach 202.91 million tons by 2034, at a CAGR of 7.03% during the forecast period 2025-2034 Asia Pacific dominates the global market in 2024.

because of the size of the manufacturing base, a developing industrialization phase and demand from end-use sectors such as agriculture, construction, and automotive. The Asia Pacific region's cost-effective production, beneficial trade policy, and many local and foreign-based chemical manufacturers are advantages for chemical distribution. Additionally, the region also benefits from modernized supply chains and expanded export networks.

Trends in China

China, as the largest country producer, has great advantages such as scale of production, domestic consumption, and supply chains that are more integrated. Investment in digital logistics and sustainability increases overall efficiency and connects regional and global chemical flows.

Chemical Distribution Market Volume & Share, By Region, 2024- 2034 (%)

| By Region | Market Volume Share, 2024 (%) | Market Volume - 2024 (Million Tons) | Market Volume Share, 2034 (%) | CAGR (2025 - 2034 ) | Market Volume - (Million Tons) 2034 | |||

| North America | 18.32 | % | 43.84 | 75.75 | 5.62 | % | 17.21 | % |

| Europe | 22.12 | % | 52.94 | 89.05 | 5.34 | % | 20.23 | % |

| Asia Pacific | 42.91 | % | 102.69 | 202.53 | 7.03 | % | 46.01 | % |

| Latin America | 8.55 | % | 20.46 | 32.71 | 4.80 | % | 7.43 | % |

| Middle East & Africa | 8.10 | % | 19.38 | 40.14 | 7.55 | % | 9.12 | % |

| Total | 100.00 | % | 239.32 | 440.18 | 6.28 | % | 100.00 | % |

What Factors are contributing to North America Becoming the Fastest-Growing Region for Chemical Distribution Market?

North America expects the significant growth in the market during the forecast period. Increased demand for specialty chemicals, an emerging digital transformation in the supply chain, and sustainable practices are all contributing to this growth. The region is moving from traditional models to value-added services that provide additional value, such as blending, repackaging, and logistics support. This transition, combined with increased reshoring of manufacturing to the U.S., is creating a new era of growth for chemical distribution.

Market Trends in the U.S.

The U.S., with its tough-to-navigate fragmented chemical industry of US$470 billion, is driving this growth in North America level. Continued mergers and acquisitions are altering the face of distribution to provide better efficiencies and access to broader retailers as firms see continuous demand increases. Additionally, superior infrastructure, increased regulatory guidance, and the rise in demand for multiple sectors including pharma, personal care and agriculture are providing dead-on opportunities in the market for boards and investors to take advantage of the alterations to the structural components of the market.

Chemical Distribution Market Segmentation

Product Type Insights

Which Product Type is the Most Dominant in Chemical Distribution Market?

The commodity chemicals segment dominated the market in 2024, due to the nature of the bulk industries such as construction, agriculture, automotive, and manufacturing. Commodity chemicals are produced at high volumes, namely solvents, acids, alkalis or other basic products used in industrial processes. The continuous demand and bulk usage along with standardisation of these items, make them preferable for distribution through recognised supply chains. the distributor assumes responsibility for bulk logistics, warehousing and compliance to ensure availability of product without interruption.

The specialty chemicals segment expect the fastest growth in the market during the forecast period, due to the rise in customised, and high-performance formulations across niche sectors. Specialty chemicals have applications in pharmaceuticals, food processing, electronics, and coatings which require a very careful handling of their formulations and rely on skilled technical support. Specialty chemicals cost more than commodity chemicals; they also enjoy high profit margins because they are purchasing from innovation led industries. Growth is supported/largely driven by emerging voluntary trends surrounding green chemistry, product differentiation and continuing product R&D.

Chemical Distribution Market Volume & Share, By Product Type, 2024 (%)

| By Product Type | Market Volume Share, 2024 (%) | Market Volume -(Million Tons) 2024 | Market Volume Share, 2034 (%) | CAGR (2025 - 2034) | Market Volume-(Million Tons) 2034 | |||

| Specialty Chemicals | 23.57 | % | 56.41 | 139.45 | 9.47 | % | 31.68 | % |

| Commodity Chemicals | 76.43 | % | 182.91 | 300.73 | 5.10 | % | 68.32 | % |

| Total | 100.00 | % | 239.32 | 440.18 | 6.28 | % | 100.00 | % |

End User Insights

Why did Industrial Manufacturing Segment Dominates the Chemical Distribution Market in 2024?

The industrial manufacturing segment dominated the market in 2024, where chemical agents are used inylemer in a variety of processes, such as chemical treatment, electronics, and machinery maintenance. Because every manufacturing process relies heavily in both commodity and specialty chemicals, there is continuous demand for large-scale distribution.

The personal care and cosmetics segment expects the fastest growth in the market during the forecast period, fueled by stronger consumer demand for skincare and beauty products. The increasing consumer preference for organic as well innovative formulation means growing demand for specialty chemicals and organized and stringent chuck distributions respond to this organization's needs by ensuring regulatory compliance distorted ingredients, trackability, and delivery continuity to even meet an evolving product development.

Chemical Distribution Market Volume & Share, By End-use, 2024 (%)

| By End-use Industry | Market Volume Share, 2024 (%) | Market Volume (Million Tons) - 2024 | Market Volume Share, 2034 (%) | CAGR (2025 - 2034 ) | Market Volume (Million Tons) 2034 | |||

| Industrial Manufacturing | 26.90 | % | 64.38 | 111.76 | 5.67 | % | 25.39 | % |

| Agriculture | 22.31 | % | 53.39 | 88.17 | 5.14 | % | 20.03 | % |

| Pharmaceuticals | 11.22 | % | 26.85 | 57.71 | 7.95 | % | 13.11 | % |

| Construction | 10.12 | % | 24.22 | 40.58 | 5.30 | % | 9.22 | % |

| Personal Care & Cosmetics | 8.11 | % | 19.41 | 44.02 | 8.53 | % | 10.00 | % |

| Food & Beverages | 7.03 | % | 16.82 | 35.21 | 7.67 | % | 8.00 | % |

| Automotive & Transportation | 6.21 | % | 14.86 | 31.74 | 7.88 | % | 7.21 | % |

| Others (Textiles, etc.) | 8.10 | % | 19.38 | 30.99 | 4.80 | % | 7.04 | % |

| Total | 100.00 | % | 239.32 | 440.18 | 6.28 | % | 100.00 | % |

Competitive Landscape in the Chemical Distribution Market

- Helm AG- Global reach in chemicals, fertilizers, and pharmaceuticals; strong in intermediates.

- Univar Inc.- Major global player; strong logistics, digital platforms, and specialty chemicals focus.

- Omya AG- Distributes industrial minerals and specialty chemicals; global manufacturing-distribution model.

- Jebsen& Jessen Offshore Pte. Ltd.- Regional distributor with expertise in offshore, marine, and industrial chemicals.

- TER Group- Distributes specialty chemicals, plastics, and ingredients, strong European presence.

- Barentz B.V.- Focuses on life sciences; delivers high-value solutions in food, pharma, and personal care.

- Azelis Holding S.A.- Strong in specialty chemicals with technical support and innovation-driven services.

- Solvadis- Specializes in sulfur products and intermediates with integrated logistics solutions.

- Ashland, Inc.- Specialty chemicals producer with a strong distribution arm in personal care and pharma.

- Brenntag AG- Largest global distributor; serves multiple industries with a wide product portfolio.

- ICC Chemicals, Inc.- Global trader and distributor of bulk and specialty chemicals; flexible sourcing/logistics.

What is Going Around the Globe?

- In April 2025, LBB Specialties and Kerry Group joined forces to introduce pharmaceutical-grade lactose to life sciences, broadening their footprint within the pharmaceutical ingredient supply chain.

- In August 2024 CHT and Gehring-Montgomery established a strategic partnership to improve chemical distribution operations throughout the U.S. to improve efficiency and market access.

For more information, visit the Towards Chem and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

More Insights in Towards Chem and Materials:

- Fertilizers Market : The global fertilizers market volume was 193.20 million tons in 2024 and is projected to grow from 199.19 million tons in 2025 to 262.18 million tons by 2034, exhibiting a CAGR of 3.10% during the forecast period.

- Polymer Modified Bitumen Market : The global polymer modified bitumen market volume was 25.70 million tons in 2024 and is projected to grow from 26.86 million tons in 2025 to 39.90 million tons by 2034, exhibiting a CAGR of 4.50% during the forecast period.

- Fluoropolymers Market : The global fluoropolymers market volume is calculated at 639.21 kilo tons in 2024, grew to 688.89 kilo tons in 2025 and is predicted to hit around 1351.23 kilo tons by 2034, expanding at healthy CAGR of 7.77% between 2025 and 2034.

- Polystyrene Market : The global polystyrene market volume was 40.09 million tons in 2024 and is projected to grow from 41.09 million tons in 2025 to 62.33 million tons by 2034, exhibiting a CAGR of 4.51% during the forecast period.

- Specialty Fertilizers Market : The global specialty fertilizers market volume is calculated at 30.23 million tons in 2024, grew to 31.75 million tons in 2025, and is projected to reach around 49.33 million tons by 2034.The market is expanding at a CAGR of 5.02% between 2025 and 2034.

- Advanced Composites Market: The global advanced composites market volume reached 2.05 million tons in 2024 and is projected to hit around 4.10 million tons by 2034, expanding at a CAGR of 7.16% during the forecast period from 2025 to 2034.

-

Copper Foil Market : The global copper foil market volume was accounted for 387.50 Kilo Tons in 2024 and is expected to be worth around 415.07 Kilo Tons by 2034, growing at a compound annual growth rate (CAGR) of 7.11% during the forecast period 2025 to 2034.

Chemical Distribution Market Top Key Companies:

- Helm AG

- Univar Inc.

- Omya AG

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Barentz B.V.

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Brenntag AG

- Nexeo Solution Holding LLC

- ICC Chemicals, Inc.

Chemical Distribution Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Chemical Distribution Market

By Product

- Specialty Chemicals

- CASE

- Electronic

- Agrochemical

- Construction

- Specialty Resins & Polymers

- Commodity Chemicals

- Synthetic Rubber

- Petrochemicals

- Plastic & Polymers

- Explosives

- Others

By End Use

- Automotive & Transport

- Agriculture

- Construction

- Consumer Goods

- Industrial Manufacturing

- Textiles

- Pharmaceuticals

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5581

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chem and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.