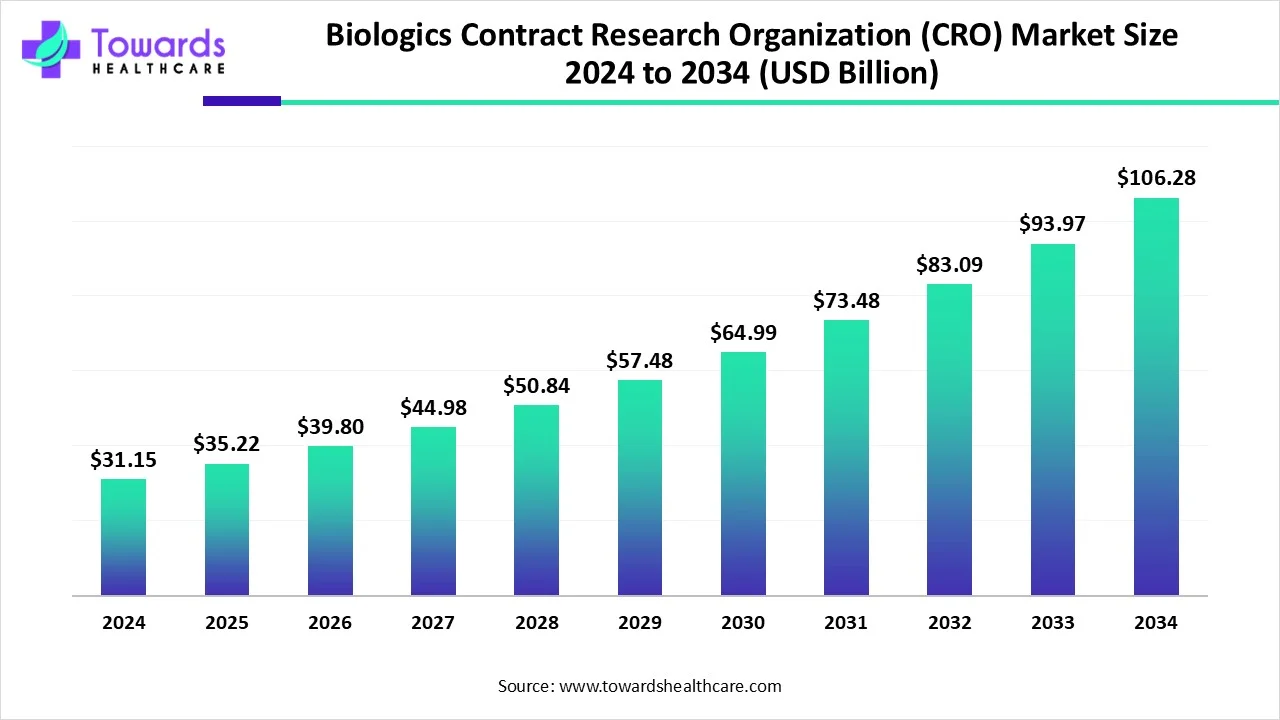

Biologics CRO Market to Soar USD 106.28 Billion by 2034, Driven by Rising Outsourcing of Complex Drug Development

The global biologics contract research organization market size is calculated at USD 35.22 billion in 2025 and is expected to reach around USD 106.28 billion by 2034, growing at a CAGR of 13.04% for the forecasted period.

Ottawa, Nov. 14, 2025 (GLOBE NEWSWIRE) -- The global biologics contract research organization market size was valued at USD 31.15 billion in 2024 and is predicted to hit around USD 106.28 billion by 2034, rising at a 13.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising because pharmaceutical and biotechnology companies are increasingly outsourcing complex biologic-drug development processes to specialist service providers to reduce cost, accelerate timelines and access advanced expertise.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5570

Key Takeaways:

- North America dominated the global biologics contract research organization market in 2024.

- Asia-Pacific is anticipated to grow at the fastest CAGR in the market during the forecast period.

- By type of biologic, the gene therapies antibodies segment held a dominant presence in the market in 2024.

- By type of biologic, the cell therapies segment is anticipated to grow at the fastest rate in the market during the studied years.

- By scale of operation, the clinical segment was dominant in the market in 2024.

- By scale of operation, the preclinical segment is expected to grow at the fastest rate in the coming years.

- By target therapeutic area, the oncology disorders segment held the highest share of the biologics contract research organization market in 2024.

- By target therapeutic area, the neurological disorders segment is estimated to grow at the fastest rate during the predicted timeframe.

Market Overview:

What is contributing to the growth of the biologics contract research organization market?

This market is rising because pharmaceutical companies are outsourcing complex biologic-drug development processes to specialist service providers to reduce cost, accelerate timelines and access advanced expertise. The increased global emphasis on biologics, including monoclonal antibodies, gene therapies and cell therapies, has created a tremendous need for highly specialized research, development and regulatory-support services.

By outsourcing to a CRO with biologics expertise, a drug sponsor can take advantage of pre-existing infrastructure, experienced staff, and regulatory expertise. As a result, the biologics CRO space has seen increased investments as the sector strives for expedited timelines from discovery to clinical trials to commercialization.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What Factors are Causing Market Expeditious Growth in the Biologics CRO Market?

- Growing biologics pipeline and modality complexity: As drug-developers are re-focusing their efforts on next-gen biologics such as gene therapies and cell therapies, the development process are becoming more technically rigorous and more costly, which is forcing sponsors to look to CROs for specialized biologics platforms and services.

- Cost-containment and outsource strategy: Given the continued rise in R&D costs with increased regulatory burden, many pharma and biotech companies are utilizing CROs in order to minimize in-house investments, rationalize their operations, and outsource non-core capabilities such as preclinical testing, bioanalytical study, and clinical trial support.

- Globalization of trials and compliance with regulation: The expansion of CROs into emerging markets, increased growth of clinical trial sites and study participants globally to relative regulatory frameworks, are creating new geographies for biologics development in CROs, leading many sponsors to partner with CROs that can provide global capabilities and multi-regional services.

- Technological innovations and digital-trial models: Recent advancements, such as Artificial-Intelligence assisted analytics, decentralized/virtual clinical trials, single-use bioreactors and high-throughput biologics screening platforms, have made CROs nimbler and faster at responding to client questions, thus providing an even greater opportunity for biologics outsourcing.

Key Drifts:

What Trends are Surfacing in the Biologics Sector?

The shift towards decentralized and virtual clinical trials for biologics is allowing for more flexible patient recruiting with site-visits reduced substantially. Further, these clinical trial models tend to produce more data on the complexities of therapeutics. As demand for more biosimilars and alternatives to biologics/drugs are rising, sponsors are increasingly employing outsourcing biosimilars as they consider alternatives for development and regulatory in support of biosimilar offerings. Biologics CROs are increasingly advancing and providing integrated end-to-end services, from to laboratory analytics to clinical trial support, to predicative analytics toward clinical development.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

High Costs and Regulatory Complexity in Biologics Outsourcing:

Despite significant opportunity in the biologics contract research organization market, one key challenge is that biologic drug development comes with high costs and significant regulatory burden. The nature of biologics typically requires specialized platforms, sophisticated manufacturing and enhanced analytical capabilities, driving development organizations to invest in infrastructure and talent in order to support the biopharma client. Along with their costs, meeting regulatory requirements for biologics (which may include immunogenicity, cell-therapy safety, gene editing oversight, etc.) creates additional challenges and risks to achieving the intended benefits of outsourcing. Each of these factors leads to the potential for delays and/or increased financial risk for the biopharma sponsor and the CRO.

Regional Analysis:

North America held the largest share of the biologics contract research organization market due to its well-established pharmaceutical and biotechnology industries, the availability of significant R&D budgets and a mature regulatory environment. Although many of the world’s biopharma sponsors are headquartered in North America, the region’s position as a leader is supported by strong clusters of clinical-trial sites across the region.

North America's concentration of the largest sponsors, its strong and established innovation clusters, regulatory incentives, and high per capita healthcare expenditure on R&D-related work are a powerful combination of factors that laid the groundwork for the region's competitive environment. Biologic therapies are likely to proliferate, and while North America remains the largest contributor to clinical-trial CRO work, the country will remain the largest center for outsourcing.

In contrast, the Asia-Pacific segment represents the largest growth opportunity for biologics CRO activity. Growth is driven by a number of converging factors occurring across many countries in the region (e.g., China, India, South Korea, etc.): increased pharmaceutical and biotechnology R&D activity; likely increased populations suitable for clinical-trial activity; relatively favorable cost structures; and improved regulatory environments to facilitate establishing and growing biologics development.

Additionally, many of the global sponsors are shifting some of their preclinical and clinical work to Asia-Pacific CROs to manage costs and plan for scale-up of biologics manufacturing in the region. With domestic demand for their own biologics increasing and an inclination to rely on CROs, the Asia-Pacific region is poised for rapid expansion in the next few years.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By Type of Biologic:

The antibodies segment prevailed in 2024 as the use of monoclonal antibodies in the development of therapeutics is expansive. Monoclonal antibodies have demonstrated efficacy, can be easily scaled-up, and have multiple clinical uses in both cancer and autoimmune therapeutics. This clearly indicates that demand for outsourcing to CROs with biologics capabilities remains robust.

The cell therapies segment is expected to have the most rapid growth in the forecast period, as pharmaceutical innovators are rapidly advancing regenerative and immune-cell based treatments. As CAR-T and stem-cell therapies become more prevalent, sponsors are seeking out biologics CROs for specialized cell-processing, validation, and regulatory support.

By Scale of Operation:

The clinical segment was the largest segment of the biologics contract research organization market in 2024, as late-phase biologic trials require large patient populations, coordination over multiple regions, and complex and often comprehensive regulatory submissions to the authorities. Sponsors of studies with late-phase biologics heavily rely on CROs to carry out or manage trial design, patient recruitment, and analytics of the data to submit to authorities for global studies.

The preclinical segment is expected to show the fastest growth as greater numbers of biologic drug candidates enter early research stages. Biotech companies are increasingly outsourcing their preclinical activities like in-vitro bioassays, pharmacokinetics testing, and toxicity studies to CROs with consolidated and sophisticated biologics research platforms.

By Target Therapeutic Area:

Oncology disorders experienced the largest market share in 2024 supported by extensive pipelines of biologics development for oncology disorders. The fragmentation nature of largely single agent antibody immunotherapy preferentially started more reliance on outsourcing for clinical trials and study analysis to CROs who have specialisation in oncology and biologics.

Neurological disorders is predicted to grow with the fastest growth trend with the significant increases in biologics innovation for neurodegenerative and central nervous system diseases. With the increase in research focusing on gene and protein-based therapies for disorders such as Alzheimer’s and Parkinson's, more reliance on CROs is expected, to provide clinical and analytical support.

Browse More Insights of Towards Healthcare:

The global biologics CDMO market size is calculated at USD 22 billion in 2024, grew to USD 25.41 billion in 2025, and is projected to reach around USD 92.79 billion by 2034. The market is expanding at a CAGR of 15.48% between 2025 and 2034.

The global biological PCR technology market was estimated at US$ 13.69 billion in 2023 and is projected to grow to US$ 28.93 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.04% from 2024 to 2034.

The global biologics safety testing market size is calculated at USD 4.03 billion in 2024, grew to USD 4.58 billion in 2025, and is projected to reach around USD 14.45 billion by 2034. The market is expanding at a CAGR of 13.64% between 2025 and 2034.

The global subcutaneous biologics market size is calculated at USD 1.89 billion in 2024, grew to USD 2.1 billion in 2025, and is projected to reach around USD 5.37 billion by 2034. The market is expanding at a CAGR of 11.09% between 2025 and 2034.

The filtration in biologics market is poised for robust growth between 2024 and 2034, driven by the increasing global demand for monoclonal antibodies, vaccines, and cell and gene therapies.

The global cancer biologics market size is expected to increase from USD 119.41 billion in 2025 to USD 232.02 billion by 2034, growing at a CAGR of 7.66% throughout the forecast period from 2025 to 2034.

The global retinal biologics market size is anticipated to grow from USD 27 billion in 2025 to USD 53.61 billion by 2034, with a compound annual growth rate (CAGR) of 7.92% during the forecast period from 2025 to 2034.

The global spine biologics market size is forecast to grow at a CAGR of 5.20%, from USD 4.65 billion in 2025 to USD 7.34 billion by 2034, over the forecast period from 2025 to 2034.

Recent Developments:

- In March 2025, Syngene International (India) acquired its first biologics-facility in the United States (at Baltimore-Bayview) from Emergent BioSolutions to bolster its large-molecule discovery, development and manufacturing services. This expansion reflects strengthening of CRO/CRDMO capabilities for biologics in global-outsourcing markets.

Biologics Contract Research Organization Market Key Players List:

- Alcami Corporation

- Alphora, Inc.

- Catalent, Inc.

- Curida Holding AS

- Fujifilm Diosynth Biotechnologies

- Lonza Group AG

- MilliporeSigma

- Samsung Biologics

- Tanvex CDMO

- Thermo Fisher Scientific

- WuXi Biologics

Segments Covered in the Report

By Type of Biologic

- Vaccine

- Cell therapies

- Gene therapies antibodies

- Recombinant proteins

- Peptides

- Other

By Scale of Operation

- Clinical

- Preclinical

By Target Therapeutics Areas

- Oncological disorders

- Neurological disorders

- Cardiovascular disorders

- Inflammatory disorders

- Other therapeutic area

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5570

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.